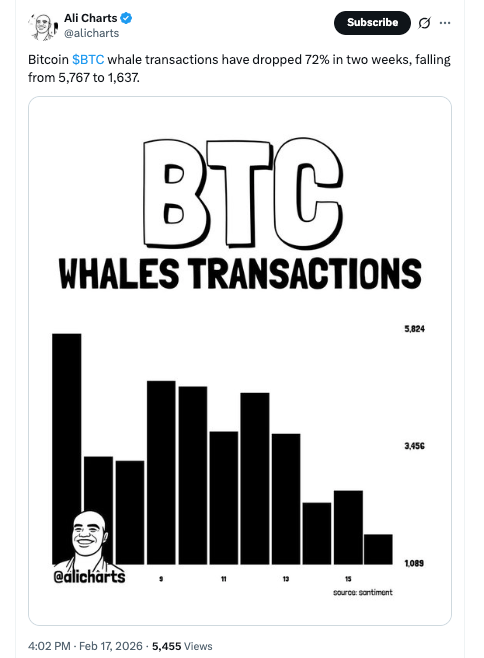

Bitcoin whale transactions have declined by 72% over the past 2 weeks, apparently slowing after the digital currency dipped below $70k. The reduced large holder activity typically indicates that the major players are cooling off and entering hibernation mode.

Popular analyst Ali Martinez tweeted regarding this development:

According to data from Santiment, a major decline in whale transactions was observed over the past 12 days, from a high of more than 5,000 to fewer than 1,800 yesterday. Some analysts were quick to point out that this indicates a lack of interest from these major market makers.

However, the other side of the equation is that the whales are going into hibernation amid the ongoing bearish squeeze and might resume activity, especially once the market agrees on a specific trend. This decline signals potential lower liquidity and volatility, with whales possibly consolidating rather than selling aggressively.

Bitcoin is currently trading between a relatively narrow $65k-$70k range. The largest cryptocurrency by market capitalization is experiencing steady consolidation following an earlier price drop that saw bears push the index to $60k at one point.

One follower replied to Ali:

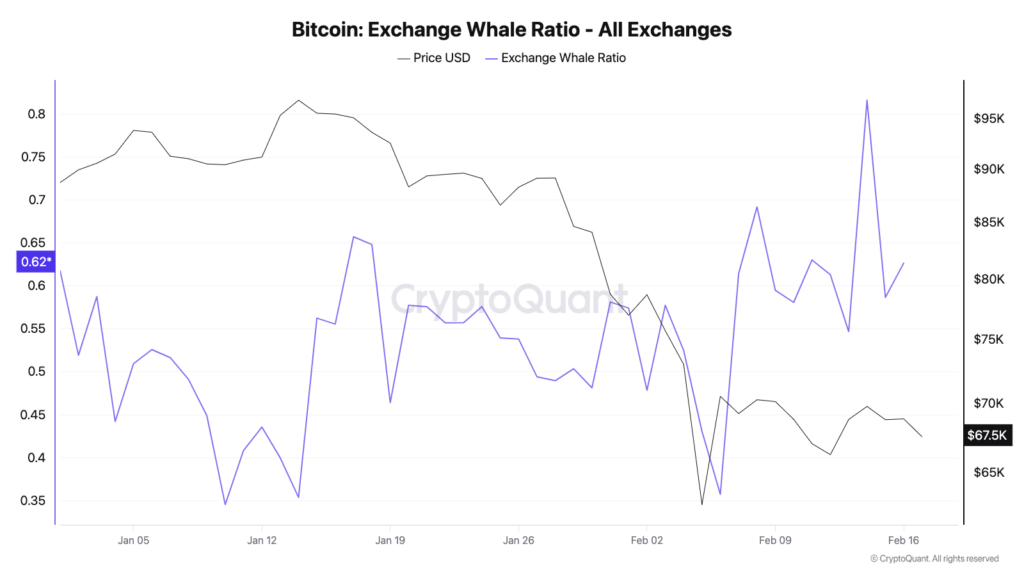

Fluctuations in Bitcoin Exchange Whale Ratio

Here is a useful Bitcoin Exchange Whale Ratio metric from CryptoQuant since the start of 2026:

Despite a slowdown in whale transaction volume and the associated price drop, whale inflow activity on major cryptocurrency exchanges has risen and reached a new high of 0.81 on February 14, earlier this week. However, just a few days earlier, it hovered around 0.31 on January 10, indicating reduced relative whale activity.

Normally, a value above 0.85 indicates a bearish signal, as whales are seeking to dominate exchange deposits and possibly sell their holdings. If the metric is below 0.85, the activity indicates increased retail dominance in exchange deposits and, as a result, is considered a bullish signal.

While we have yet to reach the 0.85 level, the rising ratio indicates that bulls will have to be on the defensive for the time being.

Verdict

The number of Bitcoin whale transactions is declining, which provides evidence that market activity is cooling in the short term. However, it is yet unclear whether this is a bullish or bearish indicator for the coming weeks.