Bitcoin (BTC) traded muted for most of the week following a turbulent month marked by a broader crypto market downturn.

Notably, over the past week, the top cryptocurrency has declined by just over 10%, driven by weakness in the tech sector and a series of negative events that have eroded crypto confidence. This weakness has led to major support levels being reached, sending analysts into confusion.

According to veteran market analyst Peter Brandt, Bitcoin could dip further, potentially to $42,000, following the recent price slump. In a Friday tweet, the pundit highlighted a long, drawn price path pattern, warning that the price could decline further following a major support breach

“If Bitcoin digs into the Banana peel as deeply as in past bear market cycles, then the bulls should not need to suffer too far south of $42,000. We are a hop, skip and jump from there.” He said.

Additionally, Brandt addressed speculation about Bitcoin’s chart patterns, dismissing claims of a head-and-shoulders top, which, if validated, could send the price to the 25,000 region. He noted that BTC’s recent formation was “a broadening top followed by a large flag,” unrelated to price movements in early 2025, and urged traders to redraw their charts accurately.

However, not all analysts share Brandt’s cautious outlook. Last Friday, JPMorgan reiterated a strongly bullish stance on Bitcoin, maintaining a long-term price target of $266,000. In a report led by managing director Nikolaos Panigirtzoglou, the bank argued that Bitcoin is becoming increasingly attractive relative to gold, particularly as recent weakness in risk assets such as technology stocks has driven investors toward alternative stores of value.

Elsewhere, asset manager Bitwise framed the recent correction as an opportunity for investors. Speaking to CNBC on Saturday, Bitwise CEO Hunter Horsley said Bitcoin’s drop below $70,000 has been interpreted differently across the market, with long-term holders growing cautious while new and institutional investors see attractive entry levels.

Horsley noted that institutional players are now seeing prices they previously believed they had missed, despite the broader macro-driven sell-off. While acknowledging that Bitcoin is currently trading within a bear market and remains influenced by moves in other liquid assets, he emphasized that demand remains strong.

According to Horsley, Bitwise clients invested a net $100 million during the recent dip below $77,000, highlighting continued buying interest.

“The volumes are very large—there are both sellers and buyers,” he added.

Meanwhile, popular crypto analyst and founder of venture capital firm MNCapital, Michaël van de Poppe, suggested that Bitcoin may have formed a near-term bottom.

On Sunday, he highlighted the recent “capitulation candle” on BTC’s weekly chart, noting that while consolidation and lower-level tests are possible, strong buying pressure could push the cryptocurrency toward $65,000–$70,000, with potential tests near $85,000.

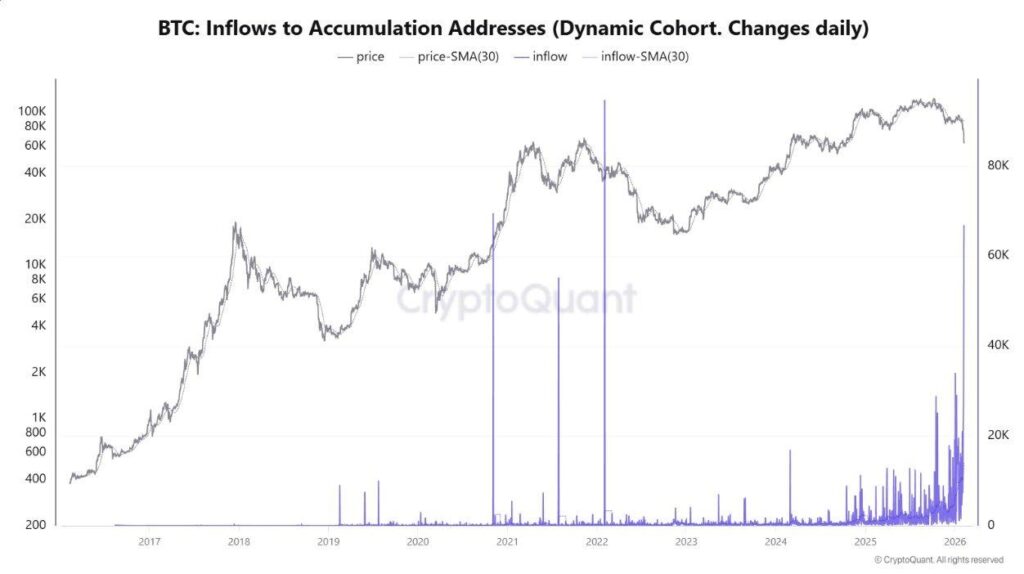

Elsewhere, On-chain data also reveals significant accumulation by institutional investors. Crypto analytics firm CryptoQuant reported that on Friday, 66,940 BTC (approximately $4.6 billion) were transferred to accumulator addresses, the largest inflow in this market cycle.

This suggests that major holders are taking advantage of the recent price dip to increase their positions, which could provide stability to the market.

At press time, Bitcoin was trading at $67,711, up 1.59% in the past 24 hours.